About Press Copyright Contact us Creators Advertise Developers Terms Privacy Policy & Safety How works Test new features NFL Sunday Ticket Press Copyright

Feed back Chat Online >>Welcome to our latest video, where we dive deep into the Solar Energy Federal Investment Tax Credit (ITC). Join us as we explore this crucial incenti...

Feed back Chat Online >>In this episode of Tax Credit Tuesday, Michael Novogradac, CPA, and Tony Grappone, CPA, discuss the upcoming transition to technology-neutral clean energy ta...

Feed back Chat Online >>This video walks through the basic steps needed to file the IRS 5695 for taking the solar tax credit on your annual taxes. The basic steps are: 1. Determine your total tax liability for the...

Feed back Chat Online >>In this video I cover the latest on the federal solar tax credit available for 2022 and beyond. I cover some quick important notes, a few examples for differ...

Feed back Chat Online >>Welcome to Optic Tax''s Ultimate Guide to the Federal Solar Energy Tax Credit! Are you considering solar energy for your home or business? Want to understand

Feed back Chat Online >>In today''s energy landscape, solar power stands out as a beacon of sustainability and financial savvy. But how does one navigate the complexities of incentiv...

Feed back Chat Online >>"Learn about Form 7205, the Commercial Clean Vehicle Credit, and Business Meal Expense in this concise video! Discover how these tax forms and credit...

Feed back Chat Online >>The IRS Form 8936 is used to claim an electric vehicle tax credit for qualified vehicles. In order to claim the credit, the vehicle must generally meet the

Feed back Chat Online >>What is the 26% solar tax credit and how does it work? Thank you for watching our newest Solar Education Series video and feel free to view our playlist to w...

Feed back Chat Online >>Lets get involved Familia 🙏🏽☀️| #NoSolarTax #PuertoRico• CORRECTION: There are Puerto Ricans on the FOMBR/La Junta. Betty Rosa, the NYS Education Departmen...

Feed back Chat Online >>Join Michael from Sunterra Energy Solutions as we delve into the solar federal tax credit, an essential incentive for adopting solar energy. We''ll explain wh...

Feed back Chat Online >>"Solar power is the last energy resource that isn''t owned yet - nobody taxes the sun yet." -Bonnie Rait #greenmaxsolarpanel #greenmaxsystems #meme #sol...

Feed back Chat Online >>If you make energy improvements to your home, you may be eligible for the energy efficient home improvement and residential clean energy property tax credits...

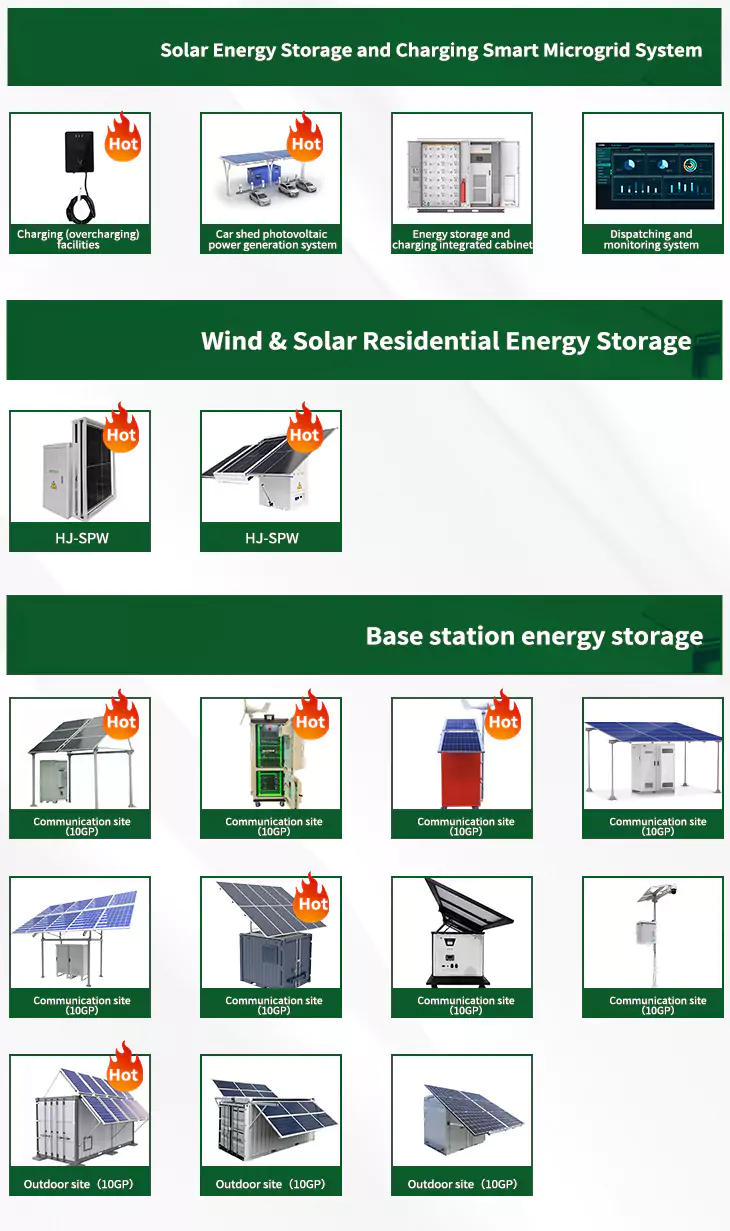

Feed back Chat Online >>As the photovoltaic (PV) industry continues to evolve, advancements in sc solar energy tax credit form have become critical to optimizing the utilization of renewable energy sources. From innovative battery technologies to intelligent energy management systems, these solutions are transforming the way we store and distribute solar-generated electricity.

When you're looking for the latest and most efficient sc solar energy tax credit form for your PV project, our website offers a comprehensive selection of cutting-edge products designed to meet your specific requirements. Whether you're a renewable energy developer, utility company, or commercial enterprise looking to reduce your carbon footprint, we have the solutions to help you harness the full potential of solar energy.

By interacting with our online customer service, you'll gain a deep understanding of the various sc solar energy tax credit form featured in our extensive catalog, such as high-efficiency storage batteries and intelligent energy management systems, and how they work together to provide a stable and reliable power supply for your PV projects.

Enter your inquiry details, We will reply you in 24 hours.